MySuper dashboard

Download a pdf version of this page

Use this dashboard to compare IOOF MySuper to other MySuper products

Find out more about IOOF Employer Super

Go to ASIC's Money Smart website for more information on how to pick the right MySuper fund for you.

ReturnInvestment return for IOOF Balanced Growth for the year ending: 30 June 2024: 10.21% |

|

Return targetCPI plus 3.5% pa after fees and taxes over a rolling 10 year basis. IOOF aims to achieve or better the return target but cannot guarantee this to occur. |

|

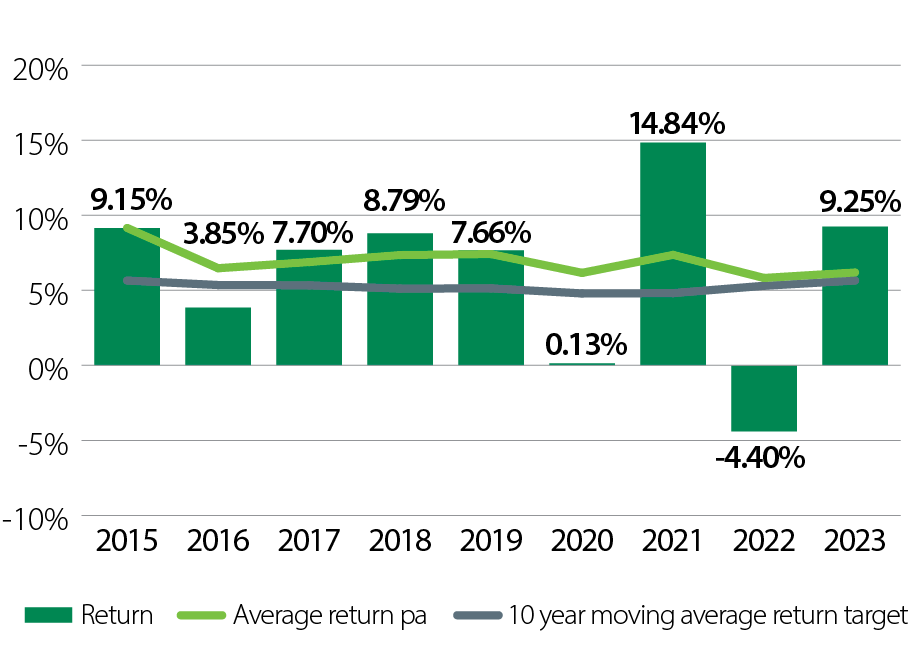

Comparison between return target and return (moving average)Comparison shown on this dashboard includes the most recent 10 financial years of the IOOF MySuper investment strategy. MySuper

|

|

Level of investment riskHigh Negative annual returns are expected in 4 to less than 6 out of every 20 years. The higher the expected return target, the more often you would expect a year of negative returns. |

|

Statement of fees and costs$5901 Fees and costs for a member with a $50,000 balance. |

1 Additional fees may apply. A buy-sell spread is incurred (as applicable) when you purchase or redeem units in a managed investment (at the time of a switch or when you move money in or out of your account). The buy-sell spread can change from time to time and is in addition to investment fees and costs, transaction costs and administration costs paid from the reserve. For more information, refer to the IOOF general reference guide available online.

Glossary

The return for IOOF MySuper has been calculated in accordance with the APRA reporting requirements. The return is after investment manager fees, IOOF MySuper fees and superannuation taxes. Fees include a fee of $90 pa and an administration fee of 0.35% and are based on a $50,000 account balance. Note, the Account Keeping Fee for MySuper changed from $117 pa to $90 pa on 14 November 2022.

The return target for IOOF MySuper has been calculated in accordance with APRA reporting requirements. Note, from 19 August 2024, the IOOF MySuper return target changed from 3.0% pa to 3.5% pa net of all fees and taxes.

Average return targets and average returns are used to show a longer term comparison so that fluctuations in returns earned each year are smoothed out. They are calculated for up to 10 years.

Fees and costs have been calculated in accordance with requirements that apply to MySuper and are detailed below:

| Example – MySuper strategy | Balance of $50,000 | |

|---|---|---|

|

Administration fees and costs |

Administration Fee: (0.35% x $50,000) Account Keeping Fee: $90 Administration costs paid from reserve ($50,000 x 0.03%) |

For every $50,000 you have in the superannuation product, you will be charged or have deducted from your investment $190.00 in administration fees and costs, plus $90 regardless of your balance. |

|

PLUS |

0.55% |

And, you will be charged or have deducted from your investment $275.00 in investment fees and costs. |

|

PLUS |

0.07% |

And, you will be charged or have deducted from your investment $35.00 in transaction costs. |

|

EQUALS |

If your balance was $50,000 at the beginning of the year, then for that year you will be charged fees and costs of $590.00 for the superannuation product. |

|

Additional fees may apply. A buy-sell spread is incurred (as applicable) when you purchase or redeem units in a managed investment (at the time of a switch or when you move money in or out of your account). The buy-sell spread can change from time to time and is in addition to investment fees and costs and transaction costs. For more information, refer to the IOOF general reference guide available online.

For further information, please contact your financial adviser or call ClientFirst on 1800 913 118.

IOOF Investment Management Limited (IIML) | ABN 53 006 695 021 | AFSL 230524 Trustee of the IOOF Portfolio Service Superannuation Fund ABN 70 815 369 818, which includes IOOF MySuper.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek advice from a financial adviser and seek tax advice from a registered tax agent. Please obtain and consider the PDS before making any decision about whether to acquire a financial product. Information is current at the date of issue and may change.